Drew Henderson

October 8, 2024

Summary

Entities holding crypto today — whether protocols, foundations, or operating companies — struggle to present their true financial position using current GAAP standards. Legacy reporting treats digital assets as a single line-item, lacking visibility into liquidity, valuation, or asset status. This not only prevents meaningful analysis but also leads to uninformed decisions.

Producing a Statement of Digital Assets (SoDA) alongside your balance sheet solves this by providing a transparent, detailed view of holdings, liquidity, and token restrictions — all in one place and in real-time. Unlike separate, one-off reports, a SoDA is generated from the same source data as the balance sheet, ensuring consistency and transparency. This standardized format helps CFOs track and evaluate performance, bridging on-chain data with financial statements while reducing overhead and minimizing risks associated with manual reporting.

SoDA isn’t just a reporting tool—it’s a foundational element for transforming digital asset management, paving the way for composable, automated, and AI-supported financial reporting. By adopting SoDA now, teams are prepared for a future where real-time reporting becomes the industry norm.

Outdated reporting standards aren’t built for crypto—they’re unintuitive and fragmented. Rather than wait for regulators to define new standards, it’s up to the industry to establish best practices. SoDA is our chance to create the reporting future we want. If you hold or report on crypto, you’re in the best position to lead this transition.

Crypto on balance sheets today

Readers of a balance sheet are simple creatures. They want to know:

With respect to digital assets, a traditional balance sheet does not answer these questions; tokens are simply aggregated in an outdated, single line-item with no respect to their actual liquidity. The most basic queries you might expect to be answered on a balance sheet simply are not:

Tokens held and their quantities

If native tokens are held and how they’re valued

The liquidity - or illiquidity - of tokens held (locked vs. unlocked)

Reasonable valuation of tokens

Stablecoin exposure

Generally Accepted Accounting Principles (GAAP) is the financial reporting language of business in the United States, therefore it's important for global businesses. GAAP does not provide a basic framework for entities that hold crypto to report on the basic token information.

GAAP is the focus point of SoDA, and is used broadly as the context for this blog post. As of today, IFRS standards are in a similar position to US GAAP with respect to lack of guidance around how digital assets are reported. Good, practicable standards and regulations are a slow process and take time.

This is how the Statement of Digital Assets (SoDA) framework was born – it was built to create transparency in a digital asset reporting framework. SoDA is the missing link between a company’s crypto holdings and their legacy GAAP financial statements.

As participants in the digital assets space, now is the time to produce and participate in setting standards.

Legacy reporting methods don’t give us any detail on digital assets

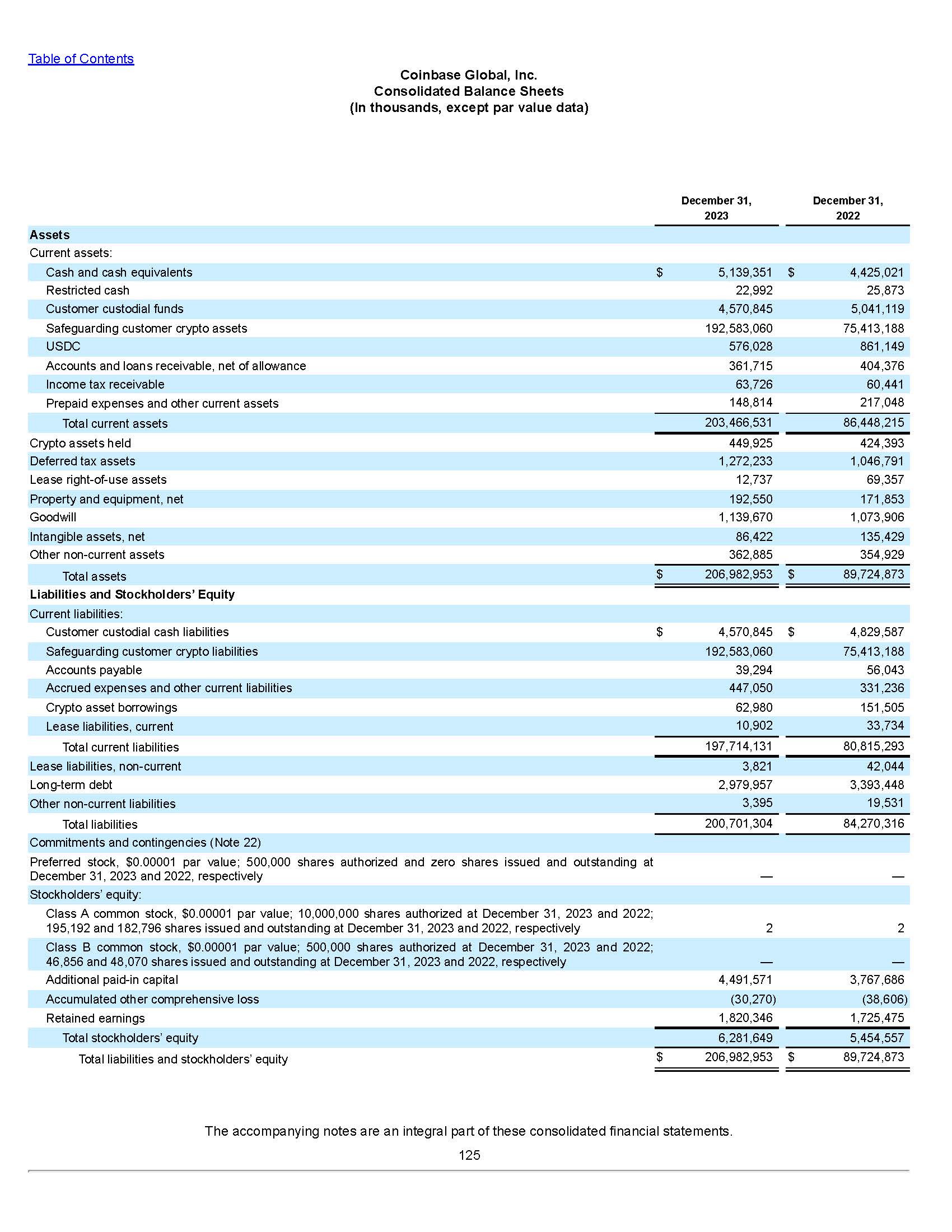

Let’s use Coinbase as an example - a large public reporter with digital assets north of $190bn. Their latest available FY23 10-K is below:

We would expect to see a report from Coinbase to include a table with the following headers:

Token | Quantity | Custody | Current Value | Valuation Method | Liquidity

We simply don’t see this in any form in Coinbase’s reporting. We don’t know what assets are held and where. Coinbase does disclose a bit more detail in its Non-GAAP Financial Measures appendices to the 10-K, but this ‘Crypto assets’ section still does not record basic elements such as quantity and liquidity – and does not provide a discrete index of all assets.

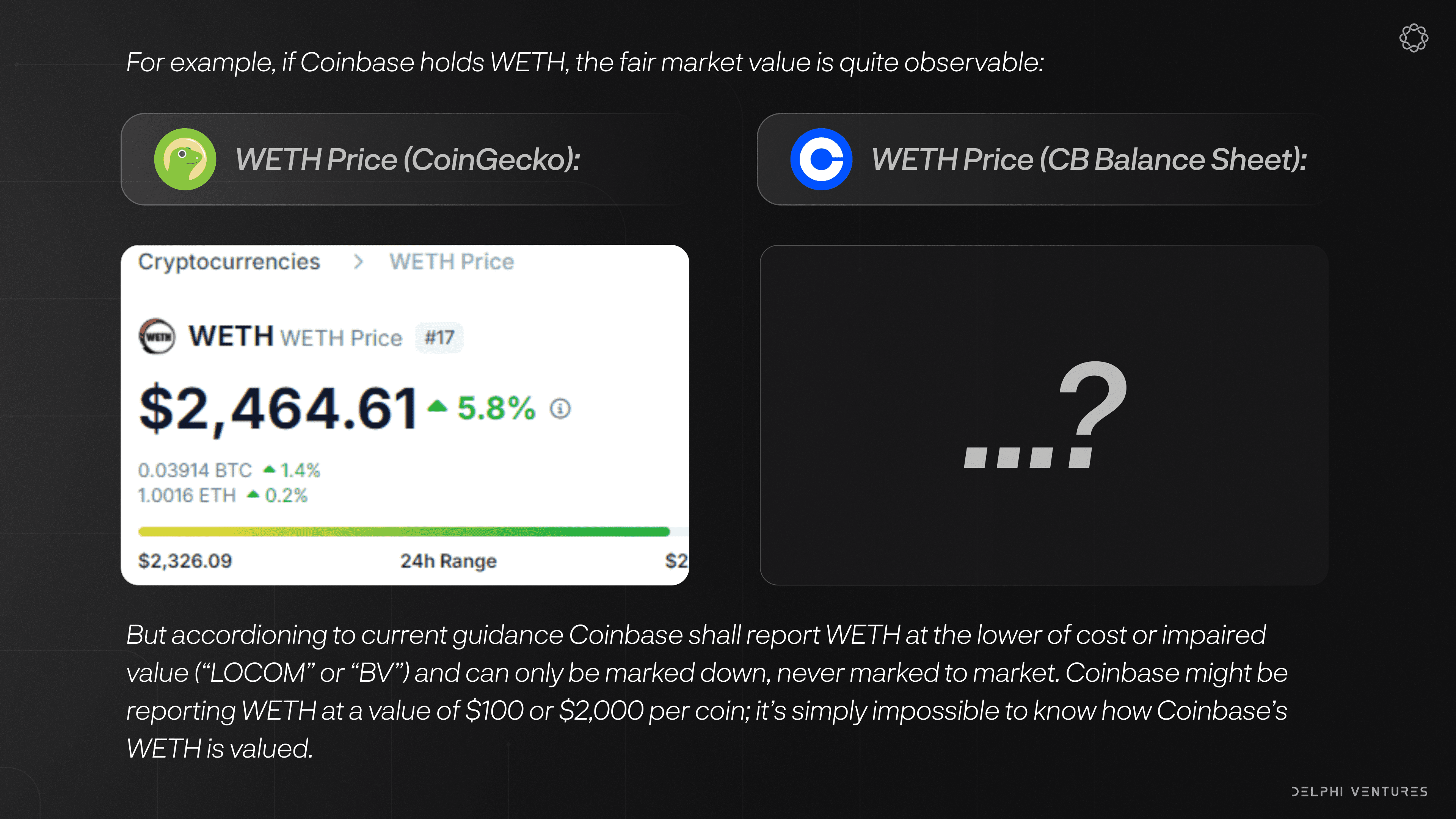

To add to the problem of this legacy reporting, the valuation of these assets is incredibly arcane. Recent guidance requires fair market value reporting of select digital assets; however, the new rules are not complete as NFTs (non-fungible tokens), native tokens (tokens created or issued by the reporting entity), select tokens representing real-world assets (RWAs), and wrapped tokens are excluded.

The combination of these obvious problems in lack of basic detail and reasonable approaches to valuation is a huge miss in delivering transparency and trust to stakeholders, investors, and counterparties.

Coinbase certainly has the technology and expertise to address these reporting matters internally. But a format on how to report consistently does not exist. That’s where SoDA comes in.

SoDA is what digital asset reporting should look like

SoDA is a tool for any entity holding crypto to bridge GAAP balance sheet reporting with their digital asset holdings. It is neither a proprietary creation, a replacement for GAAP, nor a revolutionary financial expression – its purpose is to supplement existing reporting by providing a complete picture of a firm’s liquidity and a transparent accounting of its digital assets.

SoDA’s goal is to report digital assets within the existing structure of GAAP and traditional finance. It was born primarily out of necessity to make operational sense of the impact of digital assets on an entity’s books.

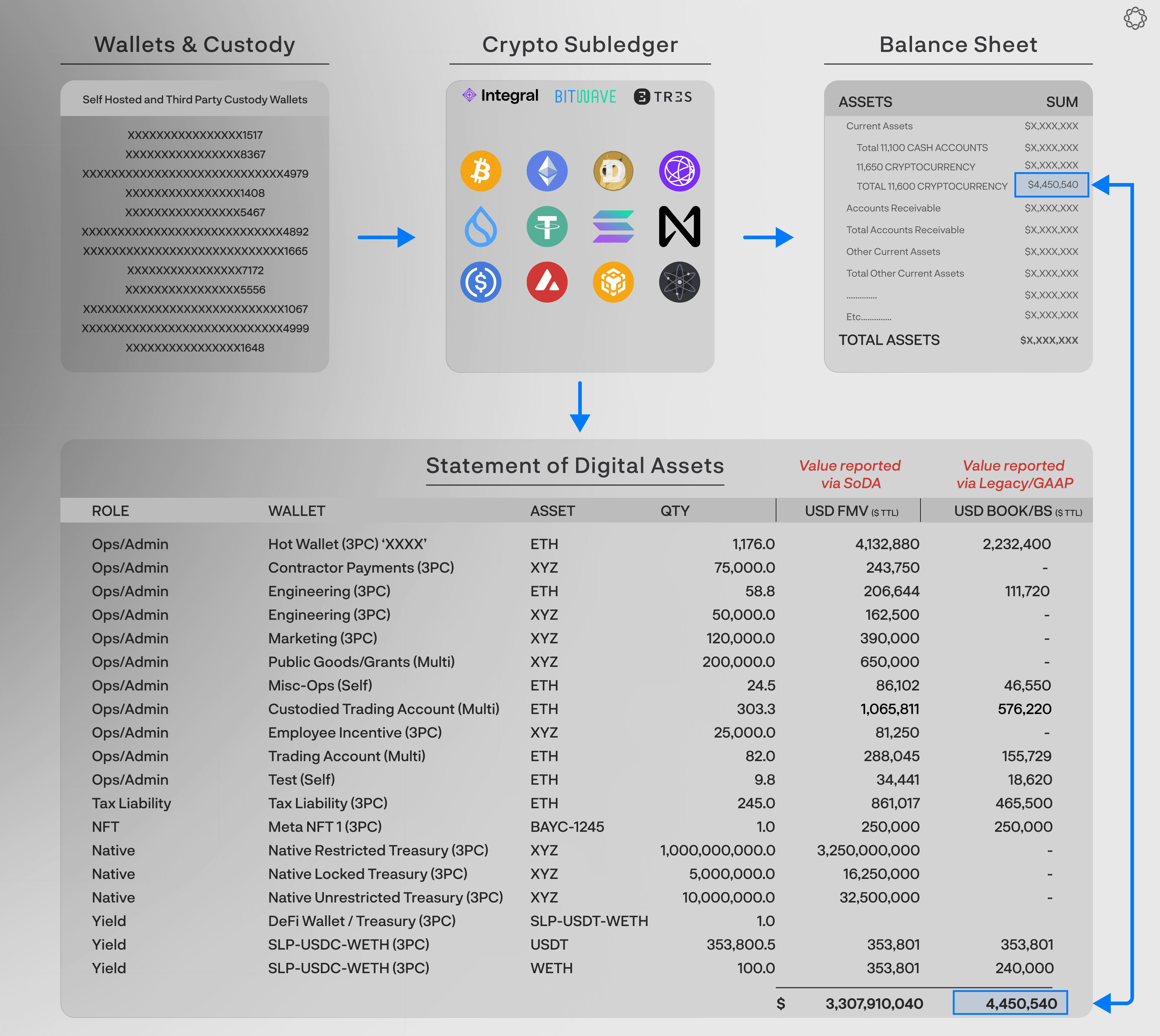

SoDA bridges the balance sheet and is born from the same source of truth. The gap between what you think you own and what you can actually use can be enormous.

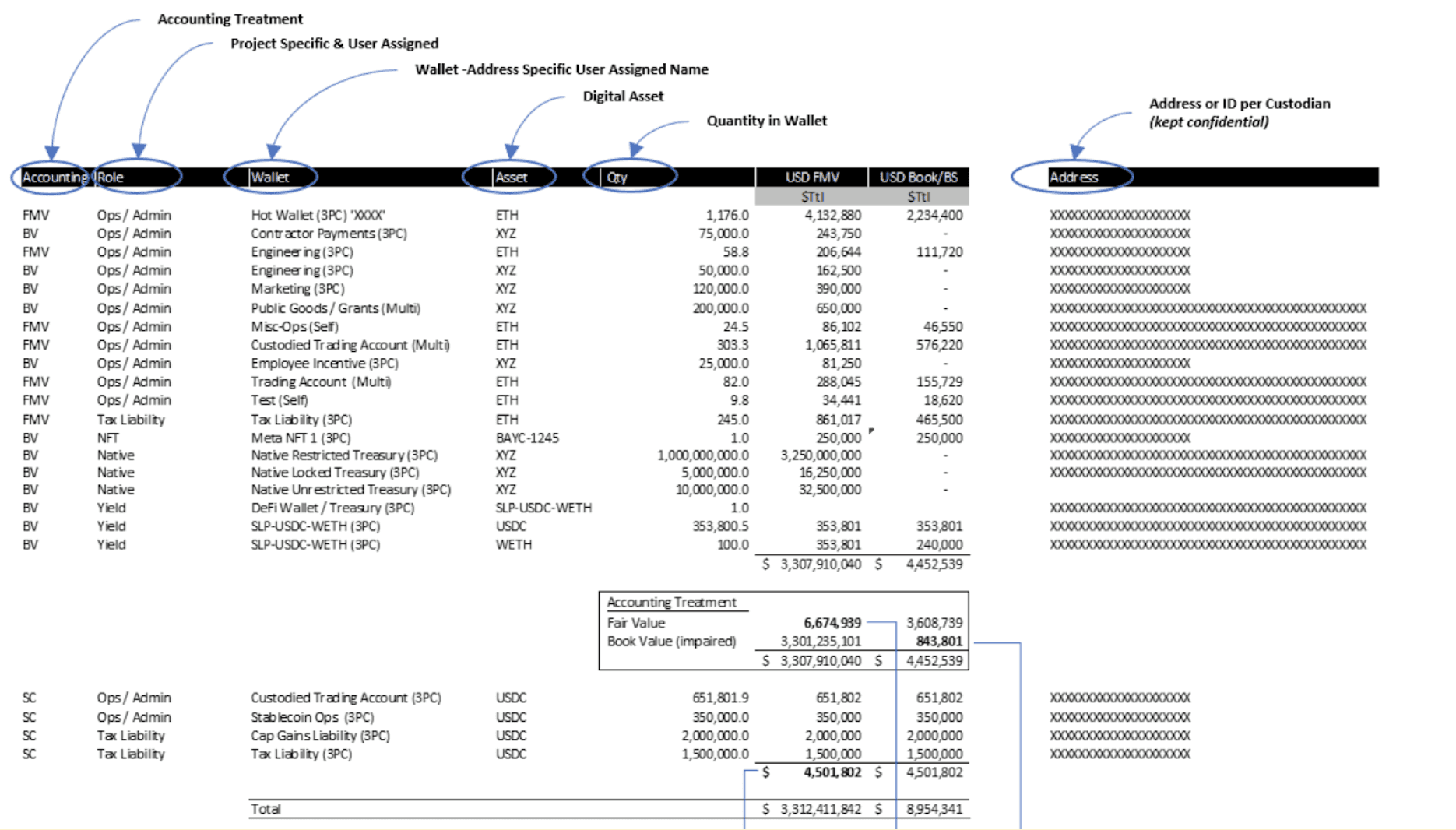

An example SoDA workbook is above. One of the key improvements SoDA brings is its ability to dissect wallet/asset pairs—each wallet’s assets are tagged by type, liquidity, risk, and restrictions. SoDA’s "wallet/asset pair" approach doesn’t just track what assets your company holds, but where they are held, what they can be used for, and what restrictions apply (if any).

Consider tokens distributed as part of an employee incentive program. These are often locked for months or years and are not immediately accessible for liquidity purposes. Legacy reporting models fail to clearly distinguish these restricted tokens from freely available assets. SoDA flags them, letting operations and auditors alike clearly see how much of a company’s treasury is truly accessible.

Of note, these fields can be tuned and hidden to match your needs and audience. For example, wallet IDs are certainly used to create the report; however, these wouldn’t generally be shared with all stakeholders for operational security.

Why does this matter?

Blockchain technologies are systems built on trustless verification. This promise is weakened if entities using this technology continue to rely on reporting methods that confuse rather than clarify.

The gap between what you think you own and what you can actually use can be enormous. An entity may assume it has sufficient liquidity for operational needs based on book value, but restricted tokens while technically “on the books” aren’t immediately usable. The risks associated with such assumptions can be severe, from tax miscalculations to liquidity crises. Without comprehensive reporting, the delta between a balance sheet and management’s backend excel files creates undue risk.

The real-world benefits

Early adopters of SoDA report reduction in accounting costs and headcount, streamlining the process of generating both managerial and financial reports. These efficiencies are not just about cutting costs; they allow protocols, businesses, and foundations to redeploy resources into higher-value initiatives.

SoDA enforces a structured, standardized format for digital asset reporting, which is crucial for preparing for AI-driven accounting workflows. As AGI tools gain the ability to ingest and analyze vast datasets autonomously, having clean, structured data will significantly reduce the time and effort needed to integrate these technologies – and reduce hallucinations. Firms that implement SoDA will have a head-start in adopting AI capabilities, such as automated reconciliation and real-time financial insights via technologies like Integral. Blockchain technologies are consistent with our world converging on near-real-time reporting requirements, and this trend is a demand of management teams and regulatory bodies like the SEC alike. This recent SEC rule demonstrates the continued trend to reduce financial reporting timelines.

Even with the recent FASB changes for digital asset accounting, the guidance isn’t complete in its inclusion of all digital assets. We believe the SoDA is an industry practice that will lead to positive change when widely adopted, and have seen its positive impact first-hand on companies. As users of blockchain tech, we here at Delphi Ventures are supporters of the SoDA framework and implement this approach across our operational entities.

Call to action

SoDA is more than a point solution — it’s the foundation for transparent and reliable financial reporting in the digital asset space. Visit sodafinance.xyz to see how SoDA can transform your reporting processes and get your ready for tomorrow.

We suggest:

Operators in the space learn via the full whitepaper on the SoDA website

Entities that hold crypto evaluate if integrating the SoDA report into their financial reporting process is appropriate

Consider endorsement of the SoDA framework

For more information, we encourage you to read the full whitepaper on the SoDA website.

If you need a SoDA-compliant digital asset technology, Delphi Ventures uses and recommends Integral. Let us know if you need a connection. Disclosure: Delphi Ventures is an investor in Integral.

Disclaimer

Unless otherwise indicated, the views expressed in this blog are solely those of the author(s) in their individual capacities and not the views of DV Parent LLC or its affiliates (collectively, “Delphi Ventures”). All opinions expressed are further subject to change without notice and may differ from opinions expressed by others.

The content of this blog is provided for informational purposes only, and does not constitute legal, business, or tax advice nor should the contents of this blog be construed as an investment recommendation or offer to provide advisory services. Readers should consult their own advisors for those matters. The content of this blog may also, at times, incorporate information sourced from third parties (including portfolio companies) and while Delphi Ventures believes such information is reliable, we have not independently verified the veracity and therefore make no representations or warranty as to its accuracy, completeness, or correctness. To the extent that this post incorporates links to external websites, the incorporation of such links do not constitute an endorsement of the content of such websites and we take no responsibility for the content therein.